Loan Match: Find the perfect loan for you!

Advertisements

With Loan Match, you can find the option that best suits your profile, thus increasing your chances of approval.

Are you looking for a loan? Don’t worry, you’re not alone! Millions of people need loans every year for a variety of reasons.

But with so many different types of loans available, it can be difficult to know which one is right for you.

Request a credit aligned to your profile It is very important to take out an advantageous loan and increase the chances of approval, for example.

In this post, we’ll discuss the different types of loans and how to find the one that’s right for you.

So to give a match with the loan that best suits your financial profile and meets your needs, follow along!

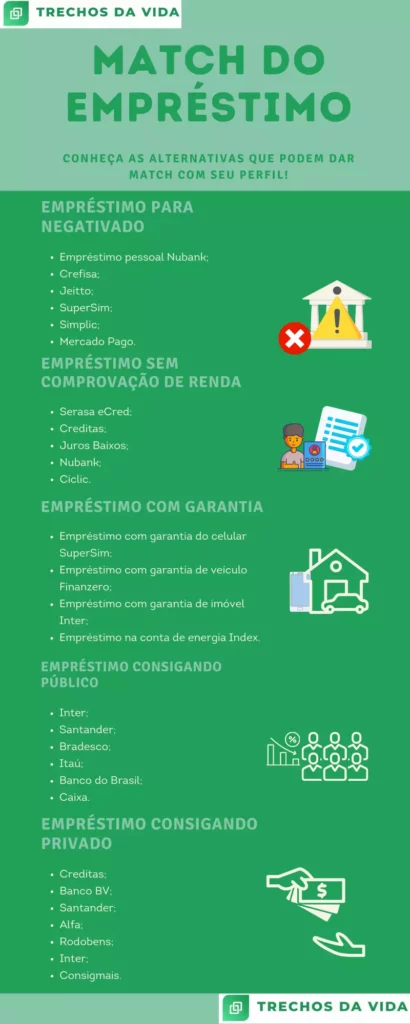

Loan for those with bad credit

If your consumer profile is one with a negative credit history, a bad credit history or a defaulter, getting approval for a loan is a huge battle.

However, although it is difficult, it is not impossible. Currently, there are different types of credit that accepts people with bad credit.

Furthermore, they are offered by different banks and financial institutions, both large and small.

Generally, when it comes to credit for people with bad credit, it is important to offer some guarantee to the bank.

However, an interesting suggestion that does not ask for any guarantee is the Nubank personal loan.

It is offered by the fintech to customers of its digital account, NuConta.

There is no advance requirement to apply, but to have a pre-approved proposal, you need to use the digital account frequently and also the account's debit card.

Initially, the amounts released are low, which may not meet your needs.

To access higher amounts, it is important to request lower amounts. If the requested amount is higher, Nubank may require proof of income during the credit analysis.

Another interesting option that provides credit for those with bad credit without bureaucracy is Jeitto.

The initial amount may be very high, but one advantage of this company is that the limit increases very easily.

However, the disadvantage is that there is no installment plan, that is, when you take the available credit, you pay the invoice with the amount you requested for the rate.

Jeitto's fare is average, even lower compared to Nubank personal loan.

Loan for those who cannot prove their income

Also known as loan for self-employed, this type of credit is ideal for those who cannot prove their income.

This loan model is very common in digital accounts, in which the bank or fintech provides loans to its customers and does not require any proof of income.

This happens because, as the customer uses their digital account, the company can trace their financial profile, for example, their payment capacity, what revenue comes in and what goes out.

This way, she can approve a fully personalized credit proposal, eliminating bureaucracy, such as presenting proof of income.

Loan with collateral

Having something to give as collateral greatly increases the chances of having a loan match.

This modality is very comprehensive and can cover consumers with different profiles, such as those with bad credit, self-employed individuals, etc.

Many people don't know, but you can take out a loan with collateral using different products, and not just a motorcycle or house, as we see happen more frequently.

For example, do you have a cell phone in good condition? Did you know that you can use it to get a loan?

Among the companies that offer this type of credit, we highlight, for example:

- Yes Loans;

- Good for Credit;

- Juvo Credit;

- SuperSim.

Payroll loan

THE payroll loan, also works as the basis for a guarantee, in this case, the guarantee is the worker's salary or benefit.

This is because the loan installments are automatically deducted from the debtor's salary, that is, without him being able to interfere.

Although it is a type of credit offered to public servants, there are companies that also offer private payroll loans, for example:

- Credits;

- BV Bank;

- Santander;

- Alpha;

- Rhodobens;

- Inter;

- Consigmals.

This alternative is considered one of the best on the market, thanks to the security of the operation that the creditor has.

As a result, he is able to offer a financial product with reduced interest rates and excellent payment conditions.

Conclusion

A loan can be a great way to get the money you need to achieve your goals.

But it’s important to find the right loan for you, based on your financial situation and needs.

With so many different types of loans available, it can be difficult to know which one is right for you.

However, with a little research, you can achieve what you dream of. Loan Match.

Search, learn about, compare and request the best alternative for you!

Contact: (11) 3164-1402

Centennial Plaza – United Nations Avenue No. 12995 – Building – Brooklin, Sao Paulo – State of Sao Paulo, 04578-911

Research source: Creditas